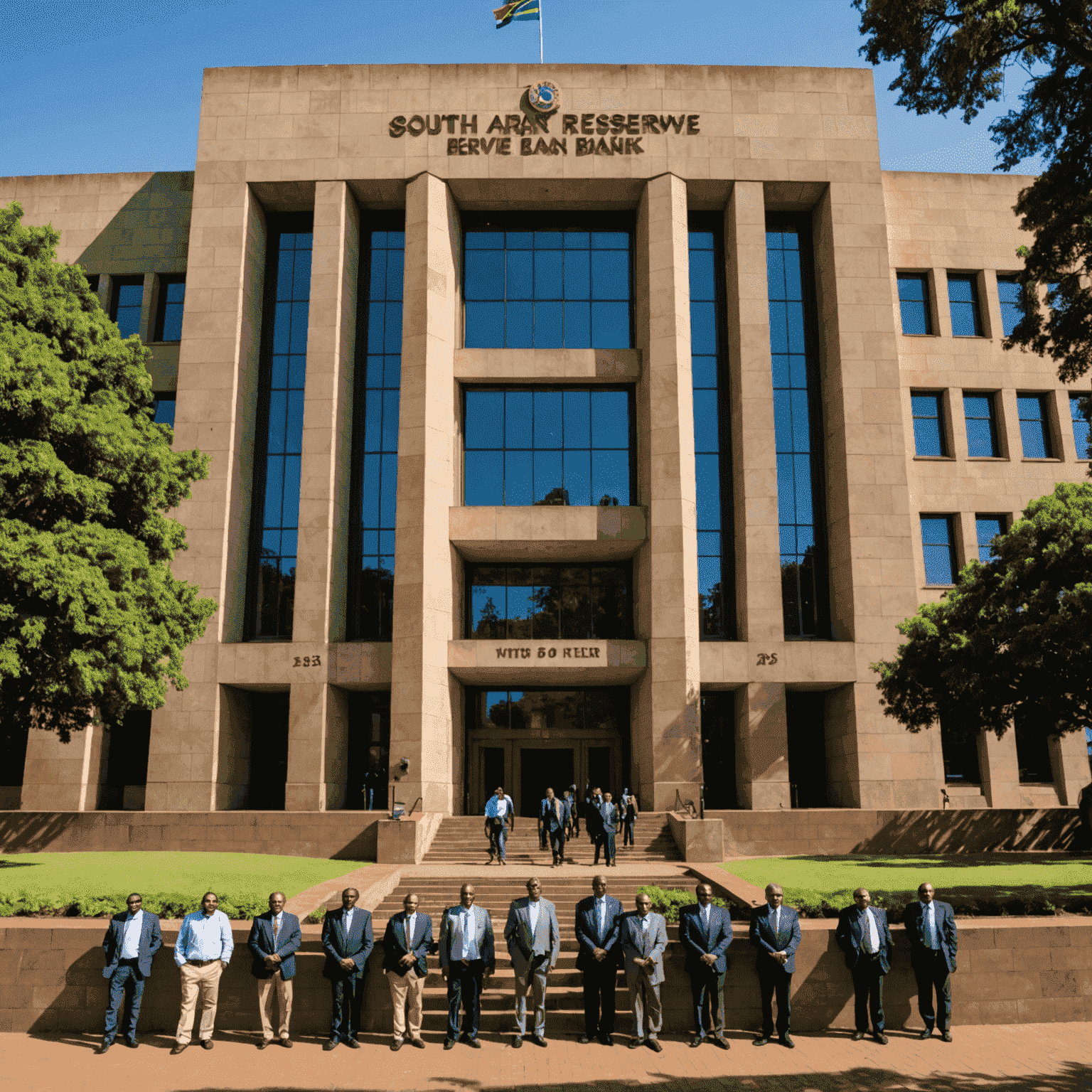

South African Reserve Bank Announces Interest Rate Decision

The South African Reserve Bank (SARB) has made a crucial decision on interest rates, impacting the nation's economic landscape and financial planning strategies.

In a move that has caught the attention of investors and financial planners across South Africa, the SARB announced today that it will be maintaining the current interest rate at 7.25%. This decision comes after careful consideration of various economic factors and is expected to have significant implications for South Africans' financial planning strategies.

The decision to hold rates steady reflects the SARB's commitment to balancing economic growth with inflation control. For South African citizens focused on organizing their economic goals and improving their financial situations, this news provides a stable foundation for creating structured savings plans and managing resources effectively.

Impact on Personal Financial Planning

For those looking to create a financial plan or use budgeting templates in South Africa, the steady interest rate offers a predictable environment. Here's how this decision might affect various aspects of personal finance:

- Savings Accounts: The current rate environment encourages South Africans to seek out high-yield savings accounts to maximize their returns.

- Mortgage Rates: Homeowners and prospective buyers can continue to benefit from relatively stable mortgage rates.

- Investment Strategies: Investors may need to reassess their portfolios, potentially considering a mix of fixed-income and equity investments to achieve their financial objectives.

- Debt Management: The steady rate provides an opportunity for individuals to focus on paying down high-interest debt without the fear of rising borrowing costs.

Planning for the Future

As South Africans continue to navigate their financial journeys, this interest rate decision underscores the importance of having a robust, step-by-step guide for finances. Whether you're looking to create a structured savings plan, manage your resources more effectively, or improve your overall economic situation, now is an ideal time to revisit your financial blueprint.

Remember, achieving financial goals requires a combination of informed decision-making, disciplined saving, and strategic planning. Use this period of rate stability to your advantage by reassessing your financial objectives and adjusting your plans accordingly.

Stay tuned for more updates and expert analysis on how this interest rate decision will shape South Africa's economic landscape in the coming months.